Terms of Business

These Terms of Business set out the general terms under which Irish Mortgage Corporation Ltd trading as Irish Mortgage Corporation, Moneycoach, (hereinafter called Irish Mortgage Corporation/Moneycoach and/or “firm” or “we”) will provide services to you as a consumer of the firm.

Please take some time to read through these and if you have any questions, we will be happy to answer same. If any material changes are made to these terms, we will notify you. These Terms of Business are effective from 11 August 2025.

The full name and address of the firm and communication details are:

Irish Mortgage Corporation Ltd (CRO 155087)

Registered Office: 118 Lower Baggot Street, Dublin 2. Telephone No: +35316691000

Email: info@irishmortgage.ie

Website: irishmortgage.com/www.moneycoach.ie

Authorised Status

Irish Mortgage Corporation Ltd trading as Irish Mortgage Corporation, IMC, Irish Pensions Corporation, and Moneycoach, (C2121) is regulated by the Central Bank of Ireland as an Insurance Intermediary registered under the European Union (Insurance Distribution) Regulations 2018, as an Investment Intermediary authorised under the Investment Intermediaries Act, 1995, as a Mortgage Intermediary authorised under the Consumer Credit Act, 1995, and as a Mortgage Credit Intermediary under the European Union (Consumer Mortgage Credit Agreements) Regulations 2016. We do not have a holding, direct or indirect, representing 10% or more of the voting rights or of the share capital in any insurance undertaking and likewise no insurer has such a holding in Irish Mortgage Corporation. We represent our customers when dealing with insurers, lenders and other product providers.

Copies of our authorisations are available on request, and these may be verified by contacting the Central Bank on 1890 777777. We are subject to the Central Bank’s Consumer Protection Code, Minimum Competency Code and Fitness & Probity Standards and all addendums which offer protection to consumers. These codes can be found on the Central Bank’s website. Irish Mortgage Corporation is a member of Brokers Ireland.

Services

The scope of our authorisation covers providing advice and arranging Pension Plans, Insurance Policies, Investment Bonds, Personal Retirement Savings Accounts, Listed Shares and Bonds, Collective Investments, Deposits and Mortgages.

Mortgages & Mortgage Related Products

We provide broad based advice on a fair and personal analysis basis in relation to the following:

- Mortgages (Residential and Commercial)

- Mortgage Related Protection Products

Life Insurance, Pensions & Investments (Moneycoach)

We provide broad based advice on a fair and personal analysis basis in relation to the following:

- Life Assurance policies – Level, Convertible & Decreasing Term, Whole of Life

- Serious Illness Cover

- Permanent Health Insurance/Income Protection

- Savings

- Insurance based investment policies

- Pension Plans, PRSAs, Approved Retirement Funds and Annuities.

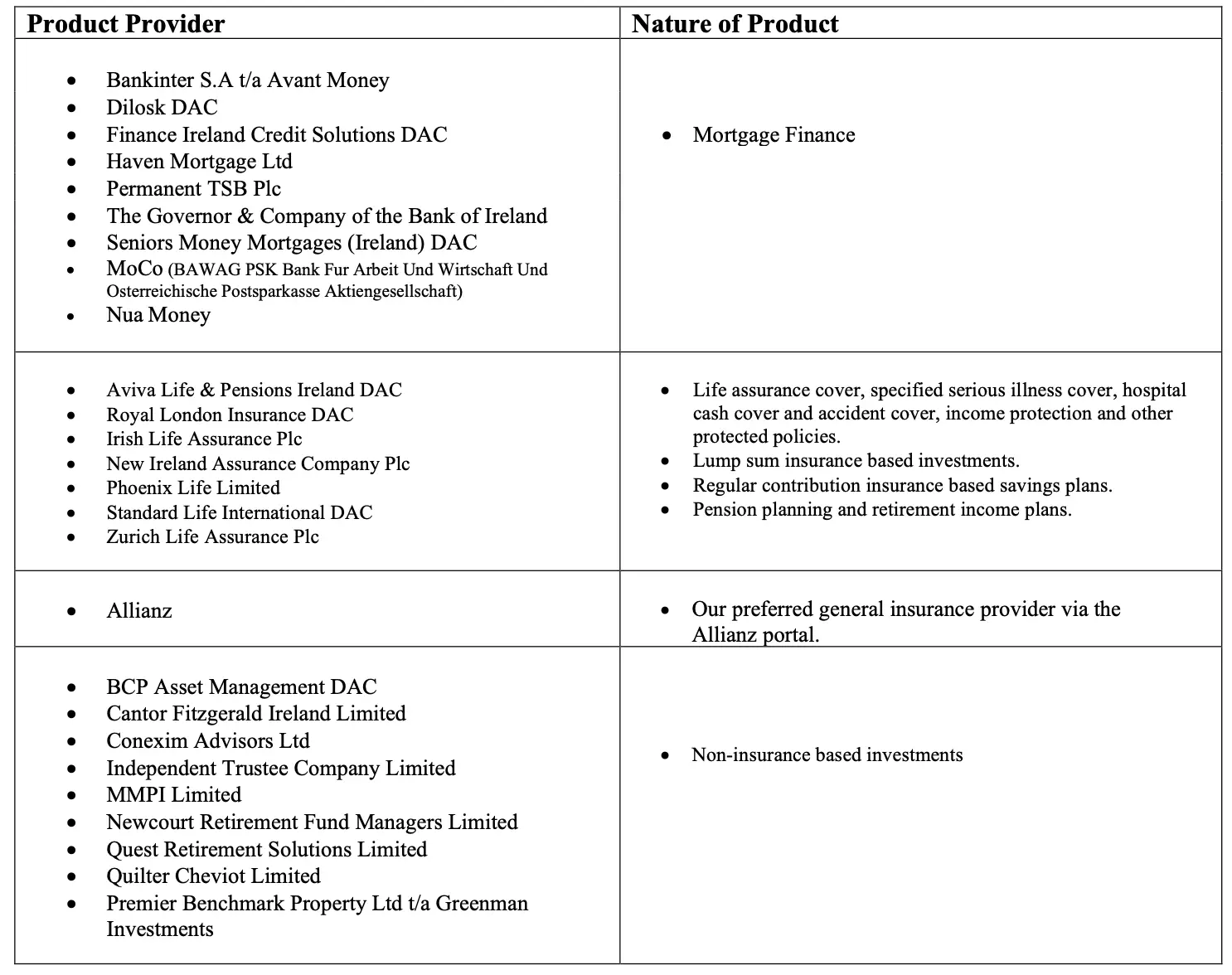

The product providers with which we currently hold agencies are shown in Appendix 1.

Non Insurance based Investment Products

In relation to non-insurance based investment products, other than bank deposit accounts, Moneycoach provides advice on a limited analysis and non-independent basis, as we may receive remuneration from the product providers of such products. These products include structured products which may typically be listed bonds and shares, collective instruments, unit trusts and tracker bonds. The product providers with which we currently hold agencies are shown in Appendix 1(Lump sum deposits/non insurance based Investments).

Mortgages

Through the lender or other undertaking with which we hold an agency, Irish Mortgage Corporation provide advice on mortgage products. Irish Mortgage Corporation provides mortgage advice on a fair analysis basis. We will need to collect sufficient information from you before we can offer any advice on mortgages. This is due to the fact that a key issue in relation to mortgage advice is affordability. Such information should be produced promptly upon our request. A full list of the agencies held is on Appendix 1of this document.

We will provide assistance to you for any queries you may have during your mortgage application. It is your responsibility to read the documents and any literature provided to you during this process to ensure you understand them fully. You should make sure you are aware of any expiry dates in terms of loan offers, or other products being offered during the process. It is imperative that you discuss in detail these expiry conditions with your solicitor to make sure they do not affect your ability to complete your purchase.

We are not ‘tied’ to any institution for any class of business.

“Fair analysis of the market” means research of a sufficiently large number of contracts and product producers available in the market to enable us to make a recommendation, in accordance with professional requirements, as regards which contract would be adequate to meet the customer’s needs.

Insurance

Irish Mortgage Corporation holds written appointments with a number of insurance undertakings, however we have selected one preferred product producer, Irish Life Assurance plc for life insurance plans (including life assurance, specified illness cover and income protection).

In relation to Irish Mortgage Corporation, limited analysis of the market for life insurance plans means the advice will be limited to products provided by Irish Life Assurance plc.

We will provide assistance to you for any queries you may have in relation to the policies or in the event of a claim during the life of the policies. It is your responsibility to read the policy documents, literature and brochures to ensure you understand the nature of the policy cover, particularly in relation to income protection and serious illness policies.

General Insurance

We provide general insurance on a limited analysis basis, by way of providing you with a portal link of our preferred general insurance partner, Allianz plc. Allianz will directly provide you with a quote.

Disclosure of Information

Any failure to disclose material information may invalidate an insurance claim and render your policy void, and you may have difficulty in obtaining insurance elsewhere. Similarly, if your circumstances change from the time of making an application for a life or mortgage product to policy issue or mortgage closing, it is your obligation to inform us and the relevant life company or lender of the change.

Ongoing Suitability/Reviews

Moneycoach will conduct periodic suitability assessments of insurance-based investment products or financial instruments on an ongoing basis where we are in receipt of an ongoing trail commission on a product. We will contact you, on a periodic basis, to arrange this review. It is in your best interests that we review, on a regular basis, the products which we have arranged for you. As your circumstances change, your needs will change and we can ensure that you are provided with up to date advice and products best suited to your needs. Failure to accept this periodic review may result in you having insufficient insurance cover and/or inappropriate investments.

Remuneration Policy

A summary of the details of all arrangements for any fee/ commission provided to us which have been agreed with product providers is available on our websites (irishmortgage.com & www.moneycoach.ie).

Moneycoach:

We may be remunerated for our services by commission from product providers, fees chargeable to clients or a combination of both. Where a fee is charged additionally and the company receives commission from a product provider, we shall explain if the commission will be offset against the fee either in part or full. Commissions received are not offset against fees unless agreed with the client in writing. The key product providers which we engage and receive remuneration from, have developed responsible investment as part of their investment philosophies and sustainability risk policies. Where we do not receive commissions from a product provider or where we provide advice only service we may charge a fee and will notify you of the fee basis in advance of any service being provided. We may receive regular renewal or trail commission while your product remains in force. All remuneration received contributes to the costs of the ongoing administration services we provide to you.

As an alternative to commission based advice, you may choose to pay our remuneration in the form of fees, or we may agree a fee for services provided on a case-by-case basis. Fees are calculated on a time spent basis, at rates determined by the nature and complexity of the relevant work and the seniority of the personnel. These fees will range from €375 per hour for Directors/Head of Financial Planning, €325 per hour for Senior Advisors, €275 per hour for Advisors and €150 per hour for Support Staff. However, in the event that a revised fee occurs, it will be set out in writing in advance of providing a service. Our comprehensive cash flow financial plan, created using Voyant software, is available as a standalone service for a fixed fee of €1,500. This fee is payable in advance and is non-refundable once planning work has begun.

Irish Mortgage Corporation:

We are remunerated by way of a commission payable by the lender. There is no client fee payable. This commission is paid by the mortgage lender after the mortgage is completed. Information on the variation in levels of commission payable by the different creditors providing the credit agreement being offered are available on request. The actual amount of commission received will be disclosed at a later stage in the ESIS (European Standardised Information Sheet) which will be forwarded to you by your lender. Please also note that the lenders may charge specific fees in certain circumstances and if this applies, these fees will be specified in your Loan Offer. Lenders require that a valuation be carried out on a property to be mortgaged. You will be required to pay the valuation fee which will be advised to you prior to the valuation being arranged.

For commercial type mortgage facilities, Irish Mortgage Corporation does not receive commission from lenders and accordingly is remunerated solely by way of a client fee. Any fee payable will be notified and agreed in advance of any service being provided. We may also refer this type of business to a specialised third party firm. Where we do so, we will agree this in advance with you before any introduction is made. We may also receive a referral fee.

For General Insurance referrals, Irish Mortgage Corporation may be remunerated by other product providers, details are available on request.

Irish Mortgage Corporation/Moneycoach may on occasion take referrals from its professional connections and reserves the right to share commission and/or fees with such connections at its discretion.

Conflicts of Interest

It is the policy of the firm to avoid any conflict of interest when providing services to its customers. However, where an unavoidable conflict may arise, we will advise you of this in writing before proceeding to provide any service. However, where an unavoidable conflict may arise, we will advise you of this in writing before proceeding to provide any service. If you have not been advised of any such conflict you are entitled to assume that none arises. We may be in receipt of “soft” commission from product providers and these will be used as revenue in the management of business and provision of services to you.

Default on payment by clients

We will exercise our legal rights to receive payments due to us from clients for services provided. Product producers may withdraw benefits or cover in the event of default on payments due under policies of insurance or other products arranged for you. We would refer you to policy documents or product terms for the details of such provisions. Mortgage lenders may seek early repayment of a loan and interest if you default on your repayments. Your home is at risk if you do not maintain your agreed repayments.

Complaints

Whilst we are happy to receive verbal complaints, it would be preferable that any complaints are made in writing, setting out the circumstances so we are clear as to the specific nature of your complaint. We will acknowledge your complaint in writing within 5 business days. We shall investigate the complaint as swiftly as possible and the complainant will receive an update on the complaint at intervals of not greater than 20 business days starting from the date on which the complaint is received. On completion of our investigation, we will provide you with a written report of the outcome. In the event that you are dissatisfied with our handling of or response to your complaint, you are entitled to refer the matter to the Financial Services and Pensions Ombudsman (FSPO), Lincoln House, Lincoln Place Dublin 2 D02 VH29. Telephone +353 1 567 7000, email:info@fspo.ie. A full copy of our complaints procedure is available on request.

Investor Compensation Company Ltd

Irish Mortgage Corporation/Moneycoach is a member of the Investor Compensation Scheme which provides certain remedies to eligible consumers on default by the firm. The Investor Compensation Act Scheme was established in 1998 and provides for the establishment of a compensation scheme and the payment in certain circumstances to certain clients (known as eligible investors) of the authorised investment firm as defined in the Act. The Investor Compensation Company Ltd (ICCL) was established in 1998 to operate such a scheme and our firm is a member of this scheme. Compensation may be payable where money or investment instruments owed or belonging to clients and held, administered or managed by the firm cannot be returned to those clients for the time being and where there is no reasonable foreseeable opportunity of the firm being able to do so. Where an entitlement to compensation is established, the compensation payable will be the lesser of 90% of the amount of the client’s loss or compensation up to €20,000. For further information, contact the Investor Compensation Company Ltd at (01) 224 4955. Any services which are not regulated by the Central Bank of Ireland will not be covered by this scheme. Irish Mortgage Corporation/Moneycoach is a member of the compensation scheme.

Broker Ireland Clients’ Compensation and Membership Benefit Scheme (BIC)

Irish Mortgage Corporation/MoneyCoach are members of the Brokers Ireland Clients’ Compensation and Membership Benefits Scheme (BIC). Subject to the rules of the scheme the liabilities of its members firms up to a maximum of €100,000 per client (or €250,000 in aggregate) may be discharged by the fund on its behalf if the member firm is unable to do so, where the above detailed Investor Compensation Scheme has failed to adequately compensate any client of the member. Further details are available on request.

Data Protection

In providing our services to clients, we may collect and process personal data from you in accordance with the General Data Protection Regulation 2018 and the Irish Data Protection Act 2018. Irish Mortgage Corporation/ Moneycoach will treat all personal information given to it in confidence and we will not disclose such information except as permitted by you or as required by law. The personal data you provide us may be held on paper or electronically and will only be used for the purposes permitted by the Data Protection Act. We will take appropriate steps to maintain the security of documents and information which are held in our possession. We may use your details and share your contact details with our product providers with which we have a formal business relationship for the purpose of providing you with appropriate advice and agreed products and services. For these purposes, we or our product providers may contact you by letter, email or telephone (landline and mobile). Full details of our Privacy Statement can be found on our website (irishmortgage.com/www.moneycoach.ie).

We may provide information in paper form or via email e.g. Terms of Business, recommendations, product brochures etc. Where you have provided us with your email address, we operate on the basis that this represents your consent to receive documentation by email. On receipt of our emails, you may request paper copies.

You have the right at any time to request a copy of any personal data within the meaning of the Data Protection Act 2018 and the General Data Protection Regulation (as amended or re-enacted from time to time) that our office holds about you and to have any inaccuracies in that information corrected. Any questions about data protection should be addressed to the Compliance Manager, Irish Mortgage Corporation Ltd, 118 Lower Baggot Street, Dublin 2.

Consumer Insurance Contracts Act 2019

The Consumer Insurance Contracts Act is aimed at enhancing consumer protection. Set out below are some specific points arising from the legislation:

New Business & Renewal

The consumer is under a duty to pay their premium within a reasonable time, or otherwise in accordance with the terms of the contract of insurance. A court of competent jurisdiction can reduce the pay-out to the consumer where they are in breach of their duties under the Act, in proportion to the breach involved.

Post Contact Stage & Claims

The consumer must cooperate with the insurer in an investigation of insured events including responding to reasonable requests for information in an honest and reasonably careful manner and must notify the insurer of the occurrence of an insured event in a reasonable time.

The consumer must notify the insurer of a claim within a reasonable time, or otherwise in accordance with the terms of the contract of insurance.

If the consumer becomes aware after a claim is made of information that would either support or prejudice the claim, they are under a duty to disclose it. (The insurer is under the same duty).

If, when making a claim, a consumer provides information that is false or misleading in any material respect (and knows it to be false or misleading or consciously disregards whether it is) the insurer is entitled to refuse to pay and to terminate the contract.

Where an insurer becomes aware that a consumer has made a fraudulent claim, they must notify the consumer on paper or on another durable means advising that they are avoiding the contract of insurance. It will be treated as being terminated from the date of the submission of the fraudulent claim. The insurer may refuse all liability in respect of any claim made after the date of the fraudulent act, and the insurer is under no obligation to return any of the premiums paid under the contract.

In addition, please note the following:

You will be asked specific questions prior to taking out a policy. You are required to answer all questions asked by us, or the insurer, honestly and with reasonable care.

An insurer may repudiate liability or limit the claim payment if it establishes that there has been non-disclosure of material information, and that the insurer would not have issued a policy or issued a policy on the terms on which it did if that information had been known to the insurer. Likewise, where there has been misrepresentation by a consumer, an insurer may, depending on the type of misrepresentation, reduce the amount of a claim or refuse to pay a claim.

A copy of an application form or proposal form, where such is relevant to the particular contract, will be provided to you showing the insurers specific questions and information required for underwriting purposes. You must review the document(s) provided and check that the answers you provided to insurers, or to us when assisting you to complete the application form or proposal form, are accurate. If any information or answer provided is incorrect you must notify us immediately.

Sustainable Investments

Sustainable investing is the process of incorporating environmental, social and governance factors into investment decisions. The key product providers with which we engage have developed responsible investment as part of their investment philosophies and sustainability policies. These providers are obliged to specify certain classifications of funds identifying whether or not they meet sustainability characteristics. We will engage with you to identify your risk attitude towards sustainable investing. We aim to provide you with investments to match your sustainable investment preferences. In some instances, we may not be able to identify funds to meet these preferences and we will explain alternative options.

Anti-Money Laundering

We are obliged by the Anti Money Laundering Legislation to verify the identity of our clients, to obtain information as to the purpose and nature of the business which we conduct on their behalf and is subject to ongoing monitoring by Irish Mortgage Corporation. The process will require sight of certain documentation and may include the use of electronic identity verification systems. These checks will be made prior to the provision of any service as well as from time to time throughout our relationship.

Consent to contact for Marketing.

At Irish Mortgage Corporation/Moneycoach, we wish to be able to stay in contact with our clients in relation to products and services which may be of benefit to you. Please be assured that your personal data will always be handled with the utmost care. If you consent to us contacting you for this purpose:

Yes ☐ No ☐.

Please also tick below to say how you would like us to contact you:

Post ☐ Email ☐ Telephone ☐ Text (SMS) ☐

Signature:_______________________ Date_________________

Appendix 1

Irish Mortgage Corporation Limited, trading as Irish Mortgage Corporation, Moneycoach, IMC, & Irish Pensions Corporation is regulated by the Central Bank of Ireland. Company Registration No. 155087

Version 05/2025 (August)

Read our Cookie Policy.

Read our Privacy Policy.